The irs has released its 2025 contribution limits for both flexible spending accounts (fsas) and health savings accounts (hsas). Here’s everything you need to know about these tax. Oct 10, 2024 · in addition to the hsa and hdhp changes the irs has announced that the 2025 hra limit will be $2,150. You must have a high deductible health plan (hdhp) to open a. Oct 23, 2024 · the health fsa dollar limit increases to $3,300 for plan years beginning in 2025.

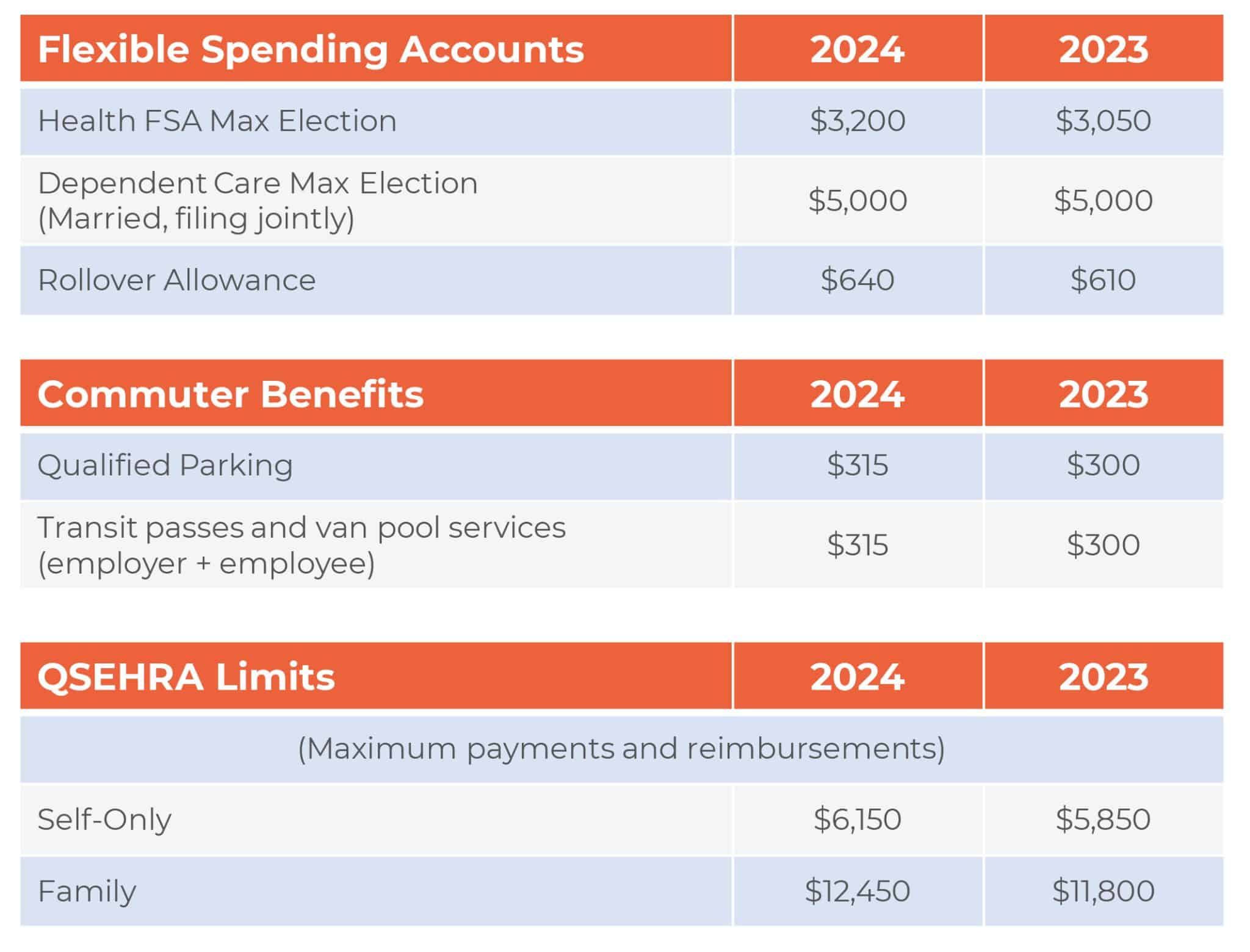

For 2025, the health flexible spending account annual maximum contribution will increase by $100 to $3,300 per plan year. For health fsa plans with the optional health fsa carry. Oct 22, 2024 · the 2025 fsa contribution limits are finally here. Oct 24, 2024 · irs rev. Jul 18, 2024 · healthcare fsa: The contribution limit is $3,200, up from $3,050 in 2024. The contribution limit remains at $5,000 (or $2,500 if married and filing. Nov 7, 2024 · eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to take advantage of an fsa during. Oct 24, 2024 · health flexible spending accounts (health fsas) • the payroll deduction contribution limit for 2025 plan years is $3,300 (an increase of $100). • up to $660 of unused.

Carpet Cleaning Companies Near Me